GROW YOUR WEALTH WITH A CASHFLOW MANAGEMENT SERVICE

A guide to how our services can help you

Discovering Cashflow Management Your Path to Financial Well-being

Whether you're building an investment portfolio, looking to pay your mortgage off sooner, managing debts, planning for retirement or saving for future goals, cashflow management is the key that unlocks these possibilities.

It's the essential foundation for efficient debt management, savvy investing and strategic financial planning. Our professional cashflow management services are designed to help you navigate your financial journey, empowering you to achieve a debt-free, secure and prosperous future faster than you thought possible.

Ask yourself the following questions:

- Do I truly understand where I spend my surplus and household money each month?

- How much of my income is available as disposable or discretionary spending, and how much is used on essentials, each month?

- Does a surplus or a shortfall currently even exist? (Monthly, Annual)

- If there is a surplus, then do I know where it has been going?

- Can I demonstrate this so that it can be clearly identified on paper?

- Am I clear about my financial objectives and goals?

- Am I also clear as to how I am going to achieve them?

- Do I have the knowledge and expertise to do this on my own and without the financial tools to assist me?

- Am I prepared to pay for a professional solution and seek assistance in order to maximise my financial potential?

| If we could help you identify just 5-10% of your income per month in additional savings, would you be willing to use these savings to double the size of your retirement/investment/property portfolio, in the space of just 10 years? That’s not a sales pitch, it is reality and here are the calculations: |

|

| Year 1: Household Income: | $100,000 |

| Year 1: Our cashflow service Impact: | 5% |

| Year 1: Value | $5,000 |

| Year 10: Year 1 x 10 x 5% return p.a, compounded | $71,034* |

| *Disclaimer: This is not advice and is used as an example only. However, it does serve to demonstrate the positive effects of compounding. It is intended to show the impact that a 5%year on year improvement in your cashflow position, can have over 10 years with a 5%return on invested funds. In this example, that places you a further $71,034 closer to achieving your financial goals! |

|

If you can relate to just some of the above questions, then with the benefit of our professional expertise, we can build a structured approach that is aligned to achieving your personal financial goals.

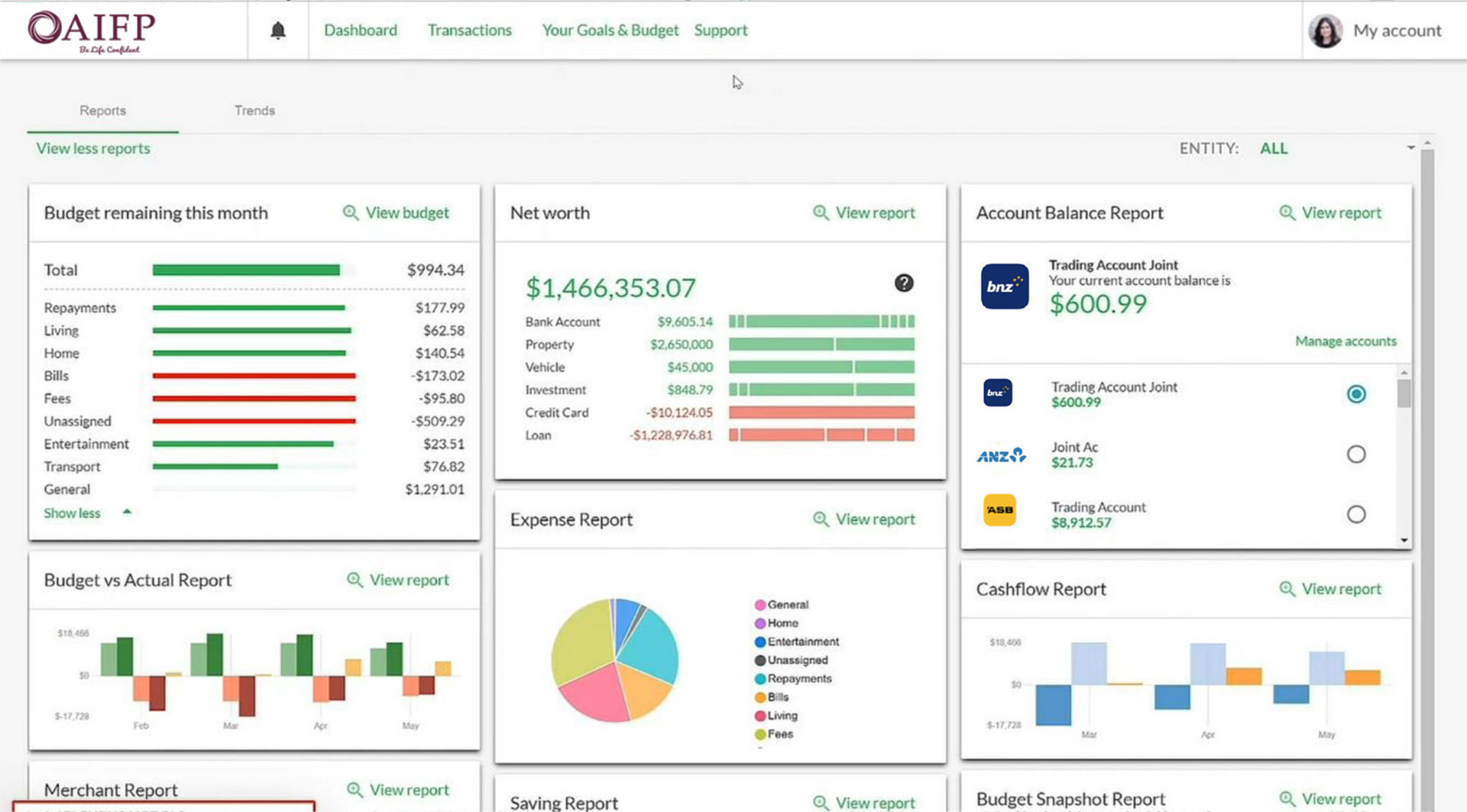

Introducing MyAIFP

MyAIFP is a state-of-the-art cashflow management and budgeting solution that supports the strategic financial planning process. It automatically retrieves and reports on your overall financial position, all in one easy-to-use platform.

MyAIFP uses real-time information, safely and securely collected from your banking and financial accounts, to provide a true and accurate picture of your situation.

This complements the ongoing discussions, reviews and actions we take as part of the service we offer. MyAIFP provides complete peace of mind that we’re always working with the most up to date information available, and always looking forward, not back.

Unlike many existing manual services, MyAIFP leaves no margin for error, so there are no ‘gaps’ or hidden surprises that are unaccounted for.

A tool such as MyAIFP is much more effective than the time- consuming cash flow tracking and budgetary processes that most people are currently using today.

If you would like to learn more about our cashflow services.

Call us or contact one of our financial advisers Today

As a client you may be thinking or asking why can’t we simply use bank statements and general information?

The answer is quite simple. The world around us changes rapidly, as does your own situation. Information is superseded quickly and today’s data could be irrelevant tomorrow. An effective service needs up-to-date information; collecting this manually can be very inefficient and is not always accurate!

Having a cashflow management plan in place provides you with the structure, discipline and understanding of why it’s important to stick with your plan to achieve your goals.

With MyAIFP to automate the data collection, we maximise time on the thing that matters most – your financial wellbeing. Here is an overview of the benefits the technology provides, in support of our service to you:

- Your banking balances, investments*, KiwiSaver*, savings will be provided daily, in real time, in a single consolidated view.

- All your liabilities including bank card balances, home loans and business loans, provided daily and in real time.

- Your regular income and expenditure will be calculated daily.

- Reporting tools are provided that clearly show your spending and savings habits.

*Depending upon your provider.

How does it work?

-

Step 01Complete a Fact Find which is designed to provide us with essential information about your current financial situation and circumstances. This process will help us better understand your current position and enable us to tailor our services to meet your specific needs effectively.

-

Step 02Connect to MyAIFP platform.

MyAIFP Consultant is here to support and guide you through the seamless onboarding process. -

Step 03Engage in a strategic meeting with your Financial Adviser, who will collaborate with you to create a tailored strategy based on your financial goals. Throughout the process, your Financial Adviser will follow the six-step advice process to ensure a comprehensive and personalised approach to meet your needs.

-

Step 04Walk the talk.

MyAIFP Consultant will actively assist you in translating the goals you have formulated with your Financial Adviser into actionable steps within the MyAIFP platform. -

Step 05Regularly review and reassess your progress by scheduling meetings with MyAIFP Consultant or Financial Adviser. These meetings will provide an opportunity for you to gauge how close or far you are from achieving your financial goals. Furthermore, these meetings enable the MyAIFP Consultant or Financial Adviser to fine-tune its approach, ensuring your financial journey remains responsive and effective.

Please be aware that if your account is not linked to a Financial Adviser, access to MyAIFP will be discontinued after three months. MyAIFP goes beyond simple budgeting tools; it is an innovative platform focused on delivering personalised financial advice. Tailored to your specific goals, the advice is based on a comprehensive understanding of your financial situation. Our aim is to provide you with the best-suited strategies and guidance to help you achieve your financial goals effectively and efficiently.

Key Features of MyAIFP

MyAIFP is easy to set-up and easy to use.

It presents a real time view of all your transactions and accounts across all providers, in one easy to view location.

You can view, monitor and manage your budget, all in one place.

A wide variety of reports are included for you and your adviser e.g. Benchmarking reports give you and your adviser unique insights plus the ability to review and compare financial behaviour and performance.

MyAIFP facilitates productive collaboration between you and your financial professional. For example, you can set and track financial goals within the MyAIFP, and then conduct periodic reviews to make sure that you’re on track.

MyAIFP empowers you the client, to take an active role in achieving your desired financial outcomes.